There’s only one kind of rumble Flin Flonners like to hear from their main employer.

Twice-daily vibrations beneath their feet signal not only ore-dislodging blasts deep underground, but also the continued health of their mining community.

All other rumbles – of cutbacks, of challenges, of any change, really – tend to make residents anxious. Such is life in a one-industry town.

So when Hudson Bay Mining and Smelting, as it was known, was sold to a junior miner known as OntZinc Corp. a decade ago, a general unease took hold.

“I think it was looked upon very nervously by the community and by people at [HBM&S] themselves,” recalls Cal Huntley, a company employee and the current mayor of Flin Flon.

“We didn’t have big brother behind us anymore. From a community perspective, there wasn’t the large mining company with the deep pockets if we got into trouble. We had to stand on our own two feet.”

The big brother in question was Anglo American PLC. The London, England-based multinational mining giant first purchased interest in HBM&S in 1961 and essentially became 100 per cent owners in 1991.

By 2004, despite having invested hundreds of millions to modernize HBM&S, Anglo wanted out of a company it no longer viewed as a strategic fit. Anglo was now more interested in investing in other base-metal operations.

Contrary to what some feared, this wasn’t a case of “sell it or close it.” Even if no interested buyer stepped forward, Anglo stressed it was prepared to keep HBM&S up and running.

For a while, it looked as though Anglo might indeed retain ownership. Months after the company publicized the possibility of a sale, nothing concrete had been announced.

Then on Oct. 7, 2004, came a bombshell. A Toronto-based company called OntZinc Corp. announced it had reached a tentative deal to acquire HBM&S.

Scarcely anyone in Flin Flon, if not Canada, had heard of OntZinc. Not only was the company diminutive, it had never owned an active mine, just a handful of prospects in Canada, the US and Chile.

OntZinc billed itself as “an emerging global producer,” but such self-generated confidence could not allay skepticism within Flin Flon.

“I’ve never heard of these guys before, and usually if you’re a player in the metals [market], you’re well known,” Tom Davie of United Steelworkers Local 7106, the largest union at HBM&S, said at the time. “If they are a junior company, I don’t think it benefits us.”

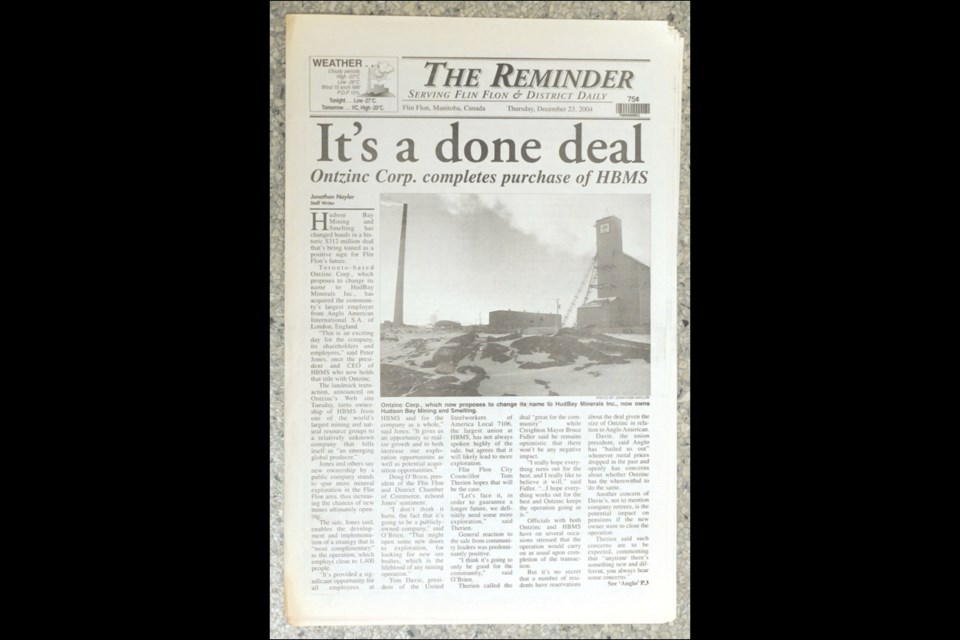

Benefits or not, on Dec. 21, 2004, Anglo completed a C$312-million sale of HBM&S to OntZinc. The sale concluded just shy of the 77th anniversary of HBM&S, which was incorporated on Dec. 27, 1927.

Two days after the sale, on Dec. 23, 2004, OntZinc changed its name to HudBay Minerals Inc., having originally considered the name Hudson Bay International Minerals Corp.

As promised, not a whole lot was different for HBM&S. In fact, HudBay Minerals appeared to place more of a premium on mineral exploration than the far-flung Anglo.

In HudBay’s first full calendar year, 2005, the company budgeted $10 million to search for ore in the Flin Flon region. Just two years later, that exploration paid off in a major way with the discovery of what would become the Lalor mine near Snow Lake.

If Flin Flon-Snow Lake was suddenly a more appealing region in which to mine, there was good reason: HBM&S was the very basis of HudBay Minerals.

Indeed following the 2008 closure of HudBay’s Balmat zinc mine in New York State, the company’s only active assets were in Flin Flon and Snow Lake.

There would be other closures besides Balmat, but nothing unexpected. In 2010, the antiquated Flin Flon copper smelter shut down, followed in 2012 by the nearby Trout Lake mine, which died of natural causes. Snow Lake’s Chisel North mine also ended its run as scheduled.

On the plus side, the Lalor mine has entered production near Snow Lake, as has the Reed mine between Flin Flon and Snow Lake. The company is also developing the massive Constancia copper mine in Peru, and hopes to establish a mine at the Rosemont copper project in the southern US.

David Garofalo, current president and CEO of Hudbay (the uppercase “B” and “Minerals” have since been dropped, as has the name HBM&S), was not with the company at the time of its formation.

But as a long-time mining executive, he can appreciate how Hudbay has progressed and evolved over the last decade.

“The last 10 years are characterized by succeeding through a respect for our history and building on our known strengths,” says Garofalo, “while at the same time defining a broader vision and then working to execute it, which we have done at Reed and Lalor and Constancia [mines]. During that time, day-to-day, we’ve focused on safety and the environment and contributing to community development too, because you can’t measure success without measuring your performance in those respects as well. I believe, by any measure, Hudbay has been tremendously successful in the past 10 years and will continue to be.”

Under Garofalo’s leadership, Hudbay is expanding beyond its Flin Flon-Snow Lake roots, as evidenced by the Constancia and Rosemont projects.

But Huntley says Flin Flon-Snow Lake is still a foundation for the company.

“We remain a cornerstone and we’re a focus for them,” he says. “Lalor mine is an indication of their dedication to the region, and certainly the continued exploration that’s going on in the Flin Flon region gives us hope that we’re going to continue to extend the life of mine around here.”

From a municipal government perspective, Huntley says Hudbay has, like Anglo, carried on a positive relationship with Flin Flon city council.

“We’ve worked well together and…and we see that as the future as well,” he says.

Asked what the next 10 years look like for Hudbay, Garofalo sounded his usual optimistic tone.

“Hudbay has a clear vision and strategy and we’ll continue executing as we have been over the last four years and as you see today at Lalor and Reed and Constancia,” he says. “777 has another several years of mine life, Reed has a five year mine life, Lalor more than 15, so that’s what we know will see us through the next 10 years. Meantime, exploration continues. Next year is the 100th anniversary of the discovery of the Flin Flon deposit. If the past predicts the future, when you look at all the growth that has come from that discovery, I think it’s safe to say the Hudbay’s next 10 years are on a firm footing that is exceptionally promising for everyone.”

Huntley shares that optimism.

“Hudbay’s future looks very good here and we tag along on that,” he says. “We are a mining town and as much as we’re going to try and diversify, we can’t disassociate ourselves from the success that comes being near to a productive and profitable mining company.”

May 12, 2004

HBM&S confirms to The Reminder that Anglo American PLC is appraising HBM&S with the view toward a potential sale. “That doesn’t imply in any way that they contemplate closure if a sale is not successfully concluded,” says Tom Goodman, vice-president of Technical Services and Human Resources for HBM&S.

October 7, 2004

Toronto-based junior miner OntZinc Corp. enters into a tentative agreement to purchase HBM&S.

“The transaction will result in the repatriation to Canada of one of its oldest and best-known mining companies,” says OntZinc chair Gregory J. Peebles.

December 21, 2004

OntZinc completes its purchase of HBM&S for

$312 million. “This is an exciting day for the company, its shareholders and employees,” says OntZinc president and CEO Peter Jones, who formerly held that title with HBM&S.

December 23, 2004

OntZinc officially changes its name to HudBay Minerals Inc. and begins trading under the symbol HBM.

February 28, 2005

HudBay announces it will move its head office from Toronto to Winnipeg, much closer to its chief assets in Flin Flon and Snow Lake.

March 22, 2006

HudBay announces net earnings of $85.2 million for 2005, its first calendar year of operations. “2005 was an excellent year on all fronts, thanks largely to solid production, good costs and strong metal prices,” says Jones.

March 20, 2007

A drill hole at the Lalor deposit near Snow Lake has intersected zinc, HudBay announces. “The first intersection at Lalor Lake is very encouraging and I look forward to the next group of holes to confirm the results of the first intersection and hopefully define a substantial and new high-grade zinc deposit,” says Jones.

August 21, 2008

The closure of the struggling Balmat zinc mine in New York State marks the first time HudBay shuts down a mine.

September 2008

HudBay confirms it will move its head office from Winnipeg back to Toronto.

June 11, 2010

The Flin Flon copper smelter closes. HudBay’s announcement says the facility is no longer feasible and would be subject to tightening pollution regulations in the coming years.

June 21, 2010

David Garofalo is appointed president and CEO of HudBay.

February 24, 2012

HudBay aligns all operations under the brand of “Hudbay.” This marks the demise of the name HBM&S.

June 28, 2012

Hudbay closes Trout Lake mine near Flin Flon, citing the depletion of viable ore.

August 14, 2012

A new mining chapter in northern Manitoba begins with ceremonies marking Hudbay’s first ore from the Lalor mine near Snow Lake and a ribbon-cutting at Reed mine between Snow Lake and Flin Flon.

August 15, 2012

A ribbon-cutting marks the new 777 North mine, an extension of Flin Flon’s

flagship 777 mine.

February 19, 2014

A loss of $109.3 million for 2013 is Hudbay’s third straight year of red ink. The company expresses optimism that 2014 will mark a turnaround.

June 23, 2014

Hudbay announces the friendly acquisition of Augusta Resources Corp. and its promising Rosemont copper project in Arizona.

November 26, 2014

Hudbay reaches a deal to possibly acquire the touted War Baby claim, situated in the middle of the 777 deposit, from Callinan Royalties Corp. The move is seen as a step toward potentially extending the life of 777 mine.